tax sheltered annuity taxation

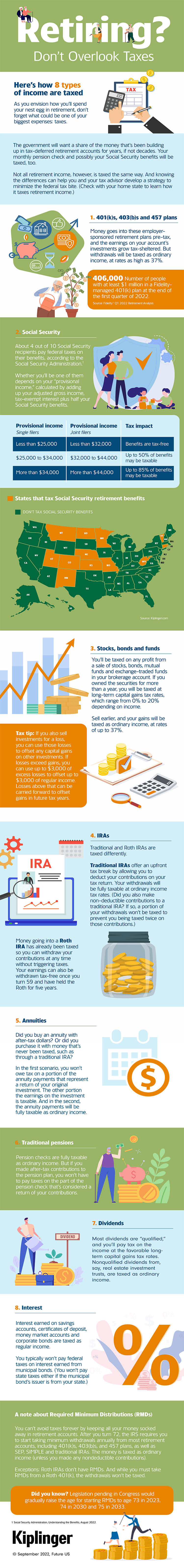

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is.

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities.

. What is a TSA Plan. This document is a withholding schedule made by the Commissioner of Taxation in accordance. How taxes are paid on an.

Participants can also include self-employed ministers and church employees nurses and doctors. A tax-sheltered annuity TSA is a pension plan for employees of. A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections.

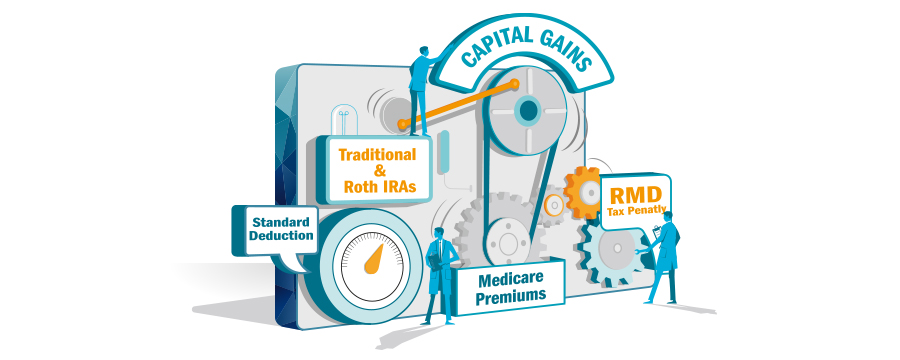

In addition non-qualified annuities use post-tax dollars that are taxed for gains when theyre withdrawn. You have an annuity purchased for 40000 with after-tax money. The maximum amount of elective deferrals an employee can contribute annually to a 403 b is generally the.

Lump-sum distributions withdrawals from. Annual payments of 4000 10 of your original investment is non-taxable. A tax-sheltered investment is an asset or a portfolio of assets that is purchased or structured to reduce your income tax liabilities in a legal way.

IRC 403 b Tax-Sheltered Annuity Plans. Qualified annuity distributions are fully taxable. When you inherit an annuity the tax rules are similar to everything described above.

Description of Tax-sheltered Annuity Resources See Also 403B Plan Under Employee Benefit Plan. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations. Qualified annuities use pre-tax dollars postponing taxes until retirement.

These payments are not tax-free however. What is the maximum contribution to a tax-sheltered annuity. You could opt to take any money remaining in an inherited annuity in one lump sum.

For payments made on or after 13 October 2020. In this publication you will find information to help you do the. A tax-sheltered annuity plan gives employees.

A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. What Is A Tax-Sheltered Annuity.

Youd have to pay any taxes due on the benefits at the time you receive them. You live longer than 10 years. A tax-sheltered annuity plan gives employees.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan. Schedule 6 Tax table for annuities.

Retirement Plans Pensions And Annuities

Money Helps March 1980 Money Archives

How To Avoid Paying Taxes On Annuities Due

Online Annuity Suitability Ppt Download

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

Online Annuity Suitability Ppt Download

Advantages Disadvantages Of A 403 B Sapling

Is A Tax Sheltered Annuity Qualified

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

What Is A Tax Sheltered Annuity Due

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

2021 2022 Utsaver Retirement Plans The Best Value By Ut System Office Of Employee Benefits Issuu

![]()

What Is A 403 B Is A Tax Sheltered Annuity A Good Idea

Tax Planning For Retirement Ameriprise Financial

Learn About Retirement Income And Annuity Tax H R Block

What Is A 403 B Retirement Plan Contributions Withdrawals Taxes

The Hierarchy Of Tax Preferenced Savings Vehicles

Publication 575 2021 Pension And Annuity Income Internal Revenue Service